Amendment 6

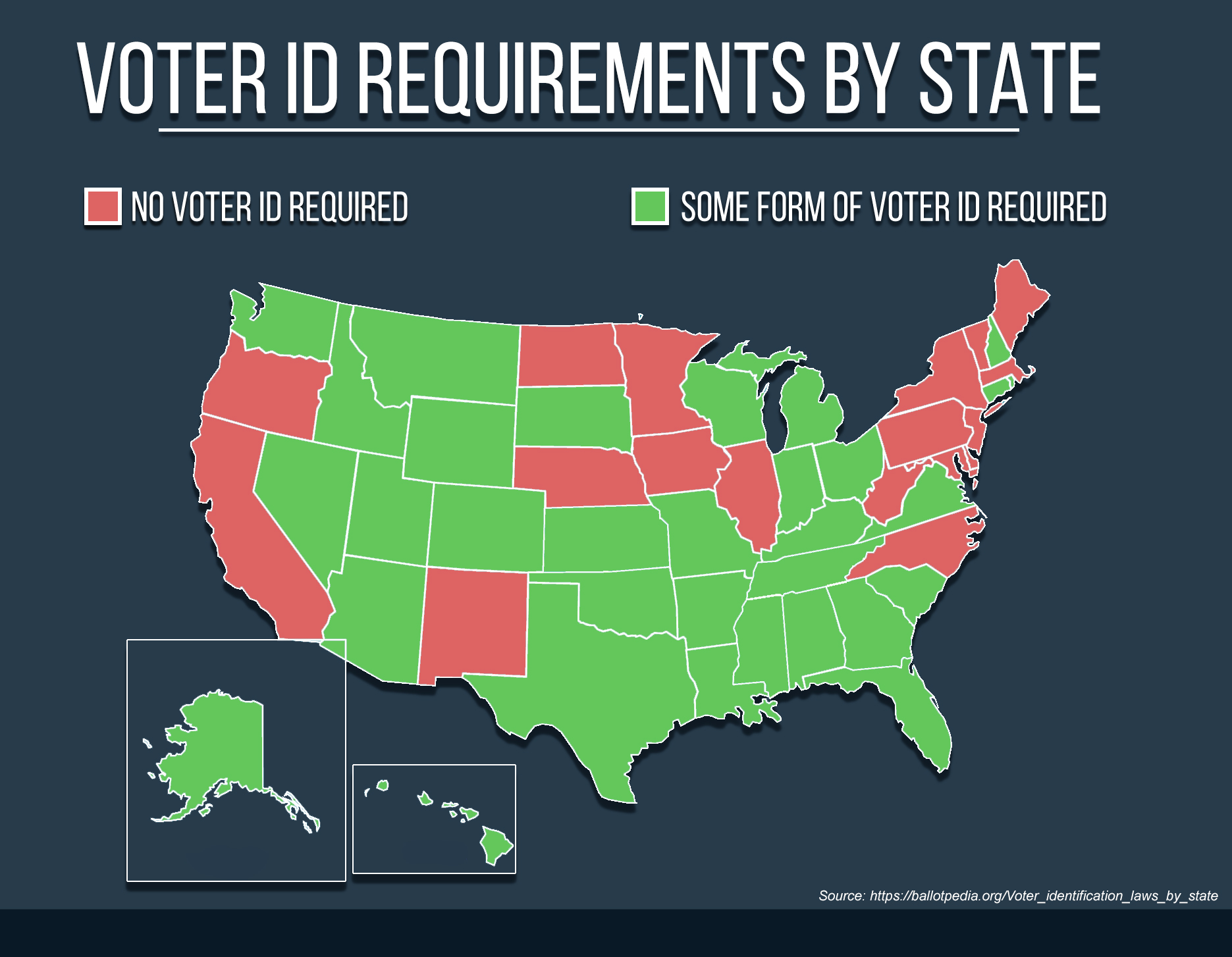

If Amendment 6 passes, voters will be required to identify themselves and present their qualifications as citizens by providing photo identification such as a driver’s license. Senator Will Kraus first proposed the bill during the Jan. 6 Missouri general assembly. The legislation passed May 11, but it will only go into effect if Missourians vote in favor of the amendment.

Stopping Voter Fraud or Disenfranchising Voters?

College Republicans President Ben Terell supports Amendment 6, saying it will protect against voter fraud. Terell says however, most cases of voter fraud are unintentional.

“It’s meant not to stop those being malicious necessarily, but maybe stem those who are doing it unconsciously,” Terrell says. “There are those who are doing it maliciously, and this will stop them as well.”

In contrast, College Democrats President Andrew Mangrum says the increased precautions proposed in Amendment 6 are unnecessary.

Like many Democrats, Mangrum says Amendment 6 will disenfranchise those who don’t have government-issued IDs.

“I’ve been going to St. Louis city a lot this past year, and the amount of people who don’t have a driver’s license there is crazy,” Mangrum says, “Not only can you not afford a car, it’s walking distance to things, so you don’t even need this ID to do things.”

According to a survey from the Pew Research Center, Americans deemed the least financially secure were 40% less likely to vote than those deemed the most financially secure during the last presidential election in 2012.

“[Amendment 6] may not be supposed to be trying to disenfranchise people, but it inevitably does because 18-year-olds, typically minorities are not able to get these drivers licenses,” Mangrum says.

Mangrum says the amendment may sound good in theory, but he says it fails in practice.

Poor Voter Turnout

Sandy Collop has been the Adair county clerk for just over a decade. As county clerk, Collop says she has witnessed zero cases of voter fraud. However, the turnout of non-fraudulent voters has been less than favorable.

“Our voter turnout is historically… not as good as we would like for it to be,” Collop says, “I’ve been here before where we’ve had a six or seven percent turnout.”

According to the Missouri Election Night Reporting Program, 63.79% of registered voters in the Adair County voted during the 2012 presidential election, accounting for only 39.61%of the total population.

Collop says many voters, especially students, miss out on the opportunity to vote because they don’t understand the rules of voter registration.

“They think they’re registered to vote in this county,” Collop says, “And then when we do some searching we find out that yes they’re a registered voter but they have registered back home.”

Proposition A and Amendment 3

On the November 2016 Missouri ballot, voters will choose between two battling ballot measures intended to implement a state cigarette tax.

Proposition A is an initiative suggested by attorney Chuck Hatfield for the benefit of state infrastructure repairs, says Stephanie Fleming, Director of Communications for the Missouri Secretary of State. It suggests an increase on cigarette taxes by 23 cents per pack by 2021 and an additional 5% sales tax for other products, including non-cigarette tobacco products. This method would require increasing the state cigarette tax by 2 cents every two years.

The proposition’s opponent is Amendment 3, proposed by attorney Edward Griem of the Graves and Garrett law firm in Kansas City, Mo. The amendment suggests a 43 cent increase on tobacco sales tax. While this is 20 cents more than Prop A, the benefits for this tax amendment are being distributed to additional organizations, such as increasing access to early childhood education programs, grants for Missouri health care facilities and smoking prevention programs.

Seeing as Missouri currently has the lowest tobacco tax in the country, it was only a matter of time before the tax was examined.

Companies pursue partnerships with serious Missouri causes

While both initiatives back economic causes, both initiatives are supported by tobacco companies, including Cheyenne International and Reynold’s American Inc. While lacking support from medical and educational organizations, Amendment 3 has the support of larger tobacco companies. These companies are required to pay a manufacturing tax, whereas smaller companies do not. This exemption only applies in the state of Missouri.

Amendment 3 includes a provision that would charge an additional 67 cent a pack tax on small tobacco companies. This would make the tobacco tax for small companies more than a dollar, closing the price gap between large and small tobacco companies,according to St. Louis Public Radio.

“They are trying to level the playing field,” Candy Young, Truman State University political science professor, says. “Essentially, the big tobacco is trying to work with a group that would have this very positive purpose, but what they are really after is making these host sellers and small tobacco companies pay a tax they are having to pay for settlement.”

With both initiatives supporting organizations or causes of public interest, this keeps them relevant to voters. Nevertheless, these are not new causes and concerns to the Missouri public. Smoking prevention has also been a national concern since the 1960’s. With Amendment 3, only 10 percent of the revenue will go to healthcare and 5 percent to smoking prevention.

“If you are only putting 5 percent of that into smoking cessation programs, do you really want people to quit or are you looking at people as a real secure source of revenue?” David Gillette, Truman State University professor, says.

Successful tobacco propositions in other states

Prop A and Amendment 3 are not the only initiatives that were proposed into Missouri, according to Ballotpedia. Numerous tobacco tax proposals have tried a failed, including Proposition B in 2012. This initiative would have created a Health and Education Trust Fund with the earnings of a $0.0365 per cigarette tax, 25% of the manufacturer’s invoice price, and 15%for other tobacco products. 50.8% of voters were opposed.

This method of taxing is not impossible. Other states, such as Arizona, Ohio and Colorado, have been successful in the approving similar initiatives. Arizona, for example, had Proposition 203 in 2006 which increased state tax on cigarettes by 80 cents per pack, as reported by the State of Arizona’s Department of Revenue. The revenue supported early childhood education through the Arizona Early Childhood Development and Health Fund. The proposition was favored by 53.2% of the voting population and passed. Currently, tobacco sales in Arizona are successfully generating roughly $120 million per year towards young children in the First Things First Program.