For the last seven years our central bank — the Federal Reserve — pursued a monetary policy called quantitative easing, which is its response to the ongoing economic crisis. While the Fed’s policy might seem distant and irrelevant to our daily lives, it is important for two reasons — it determines the interest rates of almost all loans in the economy and is a good indicator of the economy’s health. The Fed’s leaders continually claim they will revert back to pre-crisis policies, but our poor economic conditions prevented them from doing so. This adds to the growing list of signs that capitalism in America is becoming even more unstable.

On a technical level, QE is when the Fed buys financial assets from its member banks. Financial assets include safe investments like Treasury bonds as well as “toxic” investments like asset-backed securities. The member banks take the new money from the Fed and loan it out to individuals and investors, with the hopes they will use it to buy things like houses or invest in new business projects. As more money is made available for loans, the interest rate banks charge falls, making it easier to get these loans. Ideally, the increase in investment will restore economic growth, create jobs and fix the crisis.

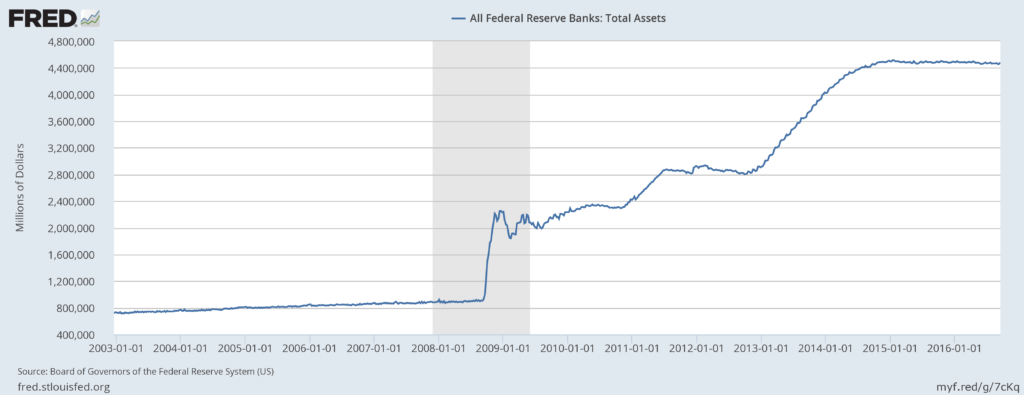

QE is an extreme policy compared to most of the Fed’s past actions, seen through two statistics. Before the crisis, the Fed held about $700-800 billion in financial assets, but when QE began it started increasing rapidly — today it has about $4.5 trillion on its balance sheets, according to the Jackson Hole Symposium hosted by the New York Fed on Aug. 26. Also, the Fed’s federal funds rate is usually between 2-8 percent, sometimes higher, but over the past seven years has fluctuated between 0 and .5 percent, according to the St. Louis Fed database. Loans have essentially been made free. Other countries are adopting similar policies, and sometimes the interest rates are set below zero in an effort to force money out of central banks and into investment.

There are several risks that come with pursuing QE for an extended period of time. One is that many of the Fed’s newly purchased financial assets are risky enough to be called “toxic” by economic experts. Many of these assets are loans made to people who are unable to pay them off, and when they default, the Fed is left with unrecoverable losses. Another is the risk of inflation, a general increase in prices. The economy does not have to respond to this new money by increasing production — businesses can also increase their prices and lower the value of the dollar. Inflation has many complicated effects on the economy, but they are generally negative when it rises too much. Also, because QE lowers the price of borrowing money, investors are incentivized to put their money into unusually risky investments, called speculation. If too many investors speculate their money and these investments fall through, the economy will take further hits in the near future.

QE was implemented with the hopes that its money injections will lead to growth, and if this happens quickly, these longer-term problems will probably not surface. However, there have been few signs that the policy is working, especially at encouraging investment. In the first half of 2016, investment fell at an annual rate of 2.1 percent, according to the CNBC article “US preliminary Q2 gross domestic product at 1.2 percent vs 2.6 percent expected” on Aug. 1. Without investment, businesses hamper their chances of growing in the future and pulling the economy out of its stagnation.

Businesses aren’t investing because they don’t see opportunities that will make them the amount of money they are used to making. This is something QE, or any Fed policy, cannot really affect because it is a problem with the real economy. Despite the “recovery,” our mainstream news corporations tell us about every week, both incomes and the rate of profit have failed to return to pre-crisis levels. For example, the median income in the United States was $3,700 fewer in 2014 — the latest data available — than at its peak in 2007, according to the St. Louis Federal Reserve. Economists like Emmanuel Saez, from the University of California, have documented the failure of most peoples’ incomes to recover after the crisis began, and our country’s widening inequality is certainly no secret.

Low income and wealth are an important part of the picture, but from my perspective, the underlying cause of our crisis is falling profitability. The rate of profit is what a business makes over how much it spends. There are many ways to measure the rate of profit, each of which count “costs” differently. Michael Roberts, a British economist, studied the rate of profit using Marxian formulas in his 2016 book “The Long Depression.” He found that profit rates in the United States were about 23 percent after World War II, fell to 13 percent by 1970, then hovered around 8-10 percent before the crisis began in 2007. Low profit rates mean investors are not rewarded for taking risks and often either hold their money or send it through wild speculative investments. He argues the only way to restore profitability is a mass “destruction of capital,” or making capital goods — factories, offices, software programs — worth less compared to the source of value, human labor.

QE is an attempt to get businesses to invest, but they are failing to do so because the economic conditions they face make new investments undesirable. Our current crisis is not a matter of higher or lower interest rates, but of fighting the cycles inherent to capitalism.